Baseball, Energy, and the Madness of Men

I can still remember sitting in class during the fall semester of 2006 when our finance professor explained efficient market theory to us onlooking youths. Like a loving parent clarifying that there is no Santa Clause he relished nothing more than justifying why he was there and not in the trenches putting money to work. “The market discounts all information into the price of each security, that is the very nature of markets.” So sure, and yet so wrong.

As described in Investopedia, efficient market hypothesis (EMH) suggests the following:

“that an investor can't outperform the market, and that market anomalies should not exist because they will immediately be arbitraged away. Fama later won the Nobel Prize for his efforts. Investors who agree with this theory tend to buy index funds that track overall market performance and are proponents of passive portfolio management.”

The problem with the theory is in it’s simplicity, at it’s very core is an imperfect understanding of how human behavior impacts market prices.

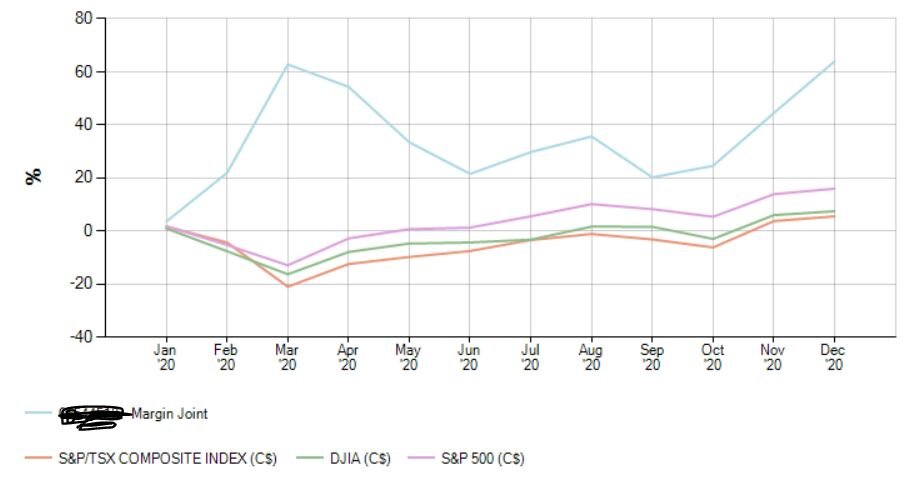

While markets may prove efficient at times, I can tell you unequivocally that they do not act efficiently where I live, on the tails. If the good professor was correct, how could my performance in 2020 (64%) and 2021 (149%) be so high, betting on the ugliest parts of the market (oil, natural gas, coal, uranium)? Was it all luck? Why were these returns not already discounted into prices?

My guess (though I’m not certain) is that it worked for the same reason Sir Isaac Newton explained after he lost nearly all his wealth betting on The South Sea Shipping company during its bubble in 1841.

Or at least so the story goes:

Following his righteous sale (and earning himself a handsome profit) Isaac saw his friends getting rich and jumped back in with all his chips prior to the eventual collapse. After the experience he penned this stunning quote:

“I can calculate the orbit of the heavenly bodies, but I cannot fathom the madness of men”

Economics of Baseball

It shouldn’t surprise you (if you read this blog and understand my bias to value investing) that one of my favorite books and subsequent movies is “Money Ball” by Michael Lewis. In the book, one of Michael’s best euphemisms is when he describes the madness of ballplayer who redesigned his swing, not to be a better ball player but to save himself the embarrassment of striking out.

“Every change he made was aimed more at preventing embarrassment than at achieving success. To reduce his strikeouts he shortened his swing, and traded the possibility of hitting a home run for a far greater likelihood of simply putting the ball in play”

Money Managers are similar and there is safety in crowds. Investing where no one else however involves reputation risk that requires courage in one’s own convictions. For this reason, the tails of the distribution are consistently undervalued or overvalued based on the typical fund client’s perception of the security.

Money managers like to say, “If it walks like a duck, talks like a duck, it’s a duck”. I believe that prevailing philosophy is often confused not in the least because it’s subject to litany of personal biases, the lens through which we perceive the world but even worse used as an excuse to stay in the acceptable lane where the career risk is tame and the AUM safe.

Not just the book but the movie, “Money Ball” is also a gem. One of my favorite parts is when Jonah Hill’s character tells Brad Pit (who is playing Billy Beane – the A’s GM) “Billy that is Kevin Youkilis, the Greek god of walks, I wanted to buy him but Shapiro said that he waddles like a duck.”

I like this analogy a lot because I too like investments that just need to walk to first base. To me that is the act of simply generating excess free cashflows and then have a management team with the wisdom and humility to get my returns home to me in the form of buybacks and dividends.

Africa Oil Corp.

Africa Oil Corp is a Canadian and Swedish listed (US OTC) oil company (headquartered in Canada) with assets in Nigeria, Kenya, Namibia, South Africa, and Guyana. The company’s only currently producing asset resides in Nigeria and will be the focus for the extent of this post.

If you’re already determined not to invest in this thing based on the pitch so far all I can say is, “I get it, so has everyone else”. But those who aren’t investors are missing out on something very special.

And that is a world class asset off-shore Nigeria that (unhedged) has the ability to generate the entire company’s market cap in free cash flow. All at extremely low operating costs.

To paraphrase investor Damian Roy on a recent Twitter Spaces, “The Nigerian asset is a Monster”.

But how come it’s so cheap is the obvious questions and for that, pick your narrative:

- Because it’s in Africa

- Because it’s oil and we already at peak consumption

- Because it’s a cyclical

- Because it’s market-cap is less than $1Billion (USD and CAD)

- Because it’s listed in Canada and Sweden (OTC in the US)

- Because it’s been the investment plaything of a wealthy Swedish family and a gung-ho chief executive for the past decade

- Because it’s crown jewel, a 50% JV, Nigerian asset called Prime Energy is accounted for via the equity method on the company’s balance sheet. Preventing any of the revenue (other than dividends) from appearing on its income statement

- Because it’s oil and “oil is bad for humanity” (see prior posts)

- Because energy has been in a near decade old bear market

- Because exploring for oil (the company’s prior objective) has been dead for half a decade

- Because index investing is the only way to invest due to EMH (see above)

- Because demographics are declining and we don’t need as much oi anymore

Shall I continue? The reasons are many. Pick a narrative, any narrative, and this thing will likely come up as a pass.

Luckily for us contrarians, I believe only two things need to go right make good money on this trade. Get on base and be brought home.

Getting on Base

Firstly, it’s important to be sure that the company can continue to generate these cash flows for the foreseeable future. That requires stability in the region. In my opinion, this hoop was cleared when the Nigerian government announced the PIA (Petroleum Industry Act) in August which is well over a decade in the making. The updating of the act includes a framework to give investors and government/citizens of Nigeria clarity as to how the industry will operate in the future. I believe this change should give the company the the confidence to wait for the right acquisition instead doing making a rash purchase based on the need to diversity it’s cashflow base.

Prime Energy (50% net to Africa Oil) get’s on base a lot!

Bring ‘em home

Secondly, management have announced to shareholders their intention to cash batters back home by enacting a shareholder return strategy that the CEO has already expressed a desire to complete (pending restrictions) and provide an update on in February.

Excerpt from the December 15, 2021 shareholder letter (Keith Hill)

Wash, Rinse, and Repeat

Summary of Thesis:

- As expressed in my previous blog posts (prisoner’s dilemma), I continue to be bullish oil (energy generally) due to the structural changes that have occurred to the industry post the 2014 shale bubble. I see structurally higher oil prices in the foreseeable future ($75+) until significant exploration capital is deployed.

- The company’s net interest in Nigeria (via 50% ownership in Prime Energy) is currently generating significant cash flow (Approx. $500M USD) at a current hedged price of $69 Brent with hedges rolling off in late spring (Brent prices currently trade approx. $90/barrel). Market cap ($750M USD).

- The producing Nigeria assets have opex costs of $5.2/barrel

- The Nigerian assets are operated by high quality operators

- The spudding of the Venus -1 well in Namibia via it’s 30.9% ownership of Impact Oil is currently being drilled by JV partner Total S.A. and the results of the drilling expected in February.

- The company has net cash at the corporate level with only $250 million net debt at the Prime Energy (Nigeria JV Interest) level.

- Fully integrated tax treatment on future dividends to Canadians (assuming a dividend will one day be paid). Preference for tax treatment and returns is buybacks at current company valuation.

The Risks

- Nigeria can be a volatile place and sabotage to energy infrastructure has been known to happen in particular to onshore pipelines/facilities. Does this extend to offshore?

- The assets will decline eventually, and new investment will be necessary. This is not an oilsands project with a 20+ year life. However, based on my understanding of this type of asset, a remaining life at slowly declining rates is at least six to seven years with minimal reinvestment.

- CEO Keith Hill has been known to make audacious acquisitions and there is a fear that the free cash flow from Nigeria will be invested into the Kenyan development assets which have been languishing for years instead of returned to shareholders. At these prices it would be significantly more accretive to simply buyback the stock and simply wait to find out what a normalized oil price is (live through next recession) before investing any more capital into Kenya.

- Nationalization and government corruption. Historically Nigeria has been an extremely corrupt state. Several years back an old boss of mine showed me a picture of his friend, an investment banker doing a deal in Nigeria, it included the banker sitting on a mountain of cash presumably being used for bribes. It’s my understanding that much has changed since then but stories such as there still permeate the investment landscape and the instability that kind of corruption causes could increase the risk of nationalization or other adverse impacts to the Prime’s operations.

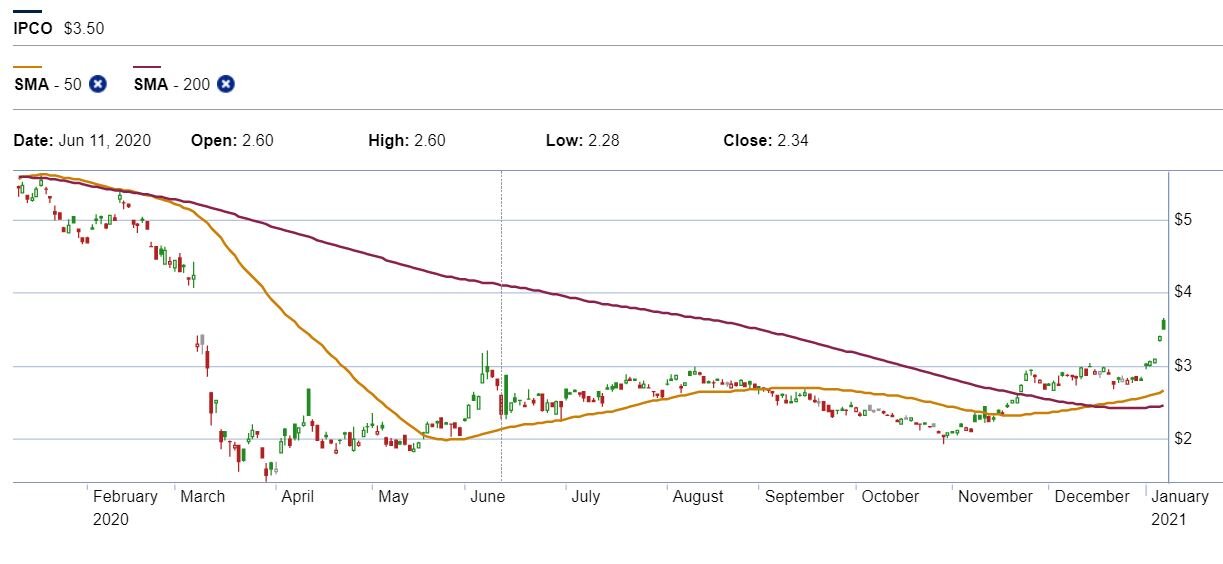

Technicals:

Oil has had a significant countertrend move in January so I wouldn’t be surprised to see Africa Oil trade back with the commodity. That said, the shares haven’t really participated in the recent oil run up to any material degree. I think this pause is likely due to two reasons, but who really knows. (1) A huge 81% run-up in the stock since the start of August being digested/profit-taking and (2) Investors waiting on hearing managements capital return strategy and Venus-1 drill results both expected in February.

Conclusion

I really like Africa Oil Corp. (AOI, AOIFF) here. I have added it as a max position size (cost base of $1.90CAD) along with my other Canadian energy names disclosed in previous posts. I think it could hit $2.80 sometime in 2022 if management avoids a silly acquisition and also signals a buyback/dividend to bring returns home to Daddy.

As always this is not financial advice and do your own due diligence.